Predictions for gaming in 2021

Tencent's next big deals, propaganda games for the party, ByteDance's forthcoming midcore titles, Genshin Impact lookalikes, Alibaba takes games abroad, the fight against platforms continues...

Hi Kalelanders,

Hope you all are safe. This week I’m writing from Zhuhai, the southern coastal city across from Macau as I’m stuck in a hotel room doing a 2-week quarantine in preparation for my trip to my parents’ in Shunde for Chinese New Year. I intentionally chose to leave Hong Kong via Zhuhai because quarantine hotels here are supposed to be better than those in Shenzhen. So far, the gamble seems to have paid off.

Anyway, before I do another news round-up piece, a list of 2021 predictions from me is long overdue. Truth is, I’ve been trying to catch up with all the prediction lists people have published in the past weeks. So don’t be surprised if I’ve borrowed some pieces of wisdom from others. As the old Chinese saying goes, 如有雷同,算我抄你。

#1 Investment spree to continue

Let’s start with a timely one.

So last year, Tencent has invested in about 30 game companies, roughly 3 times more than it had in each of the past years. And just in January, we’re already seeing Tencent pumping money in seven game companies. The deals in Klei Entertainment and Dontnod have caught the most attention in the West.

Clearly, Tencent is not slowing down, and instead it is putting its pedal to the metal. These two early deals may well be just a prelude. Reports in January said that Tencent is looking to raise US$1 billion to buy game companies. While details remain scarce, people familiar with the matter said that target companies are likely based in the US or South Korea.

With a recent rally, Tencent is on pace to become Asia’s first company to reach a market capitalization of US$1 trillion. With Chinese New Year just weeks away and the Covid-19 situation taking a turn for the worse, Tencent may be soon getting another revenue boost as people are stuck at home playing games during the holiday.

Needless to say, this ambitious push to invest in the global gaming market extends beyond Tencent. With Chinese games going overseas being the main trend of the sector, more investments from Chinese game companies can certainly be expected in 2021.

#2 Propaganda games for the CCP

As Charles Barkley would say, this one is a guarantee.

This year, we’ll be seeing a flood of propaganda games. The reason is simple: it’s the 100th anniversary of the Chinese Communist Party.

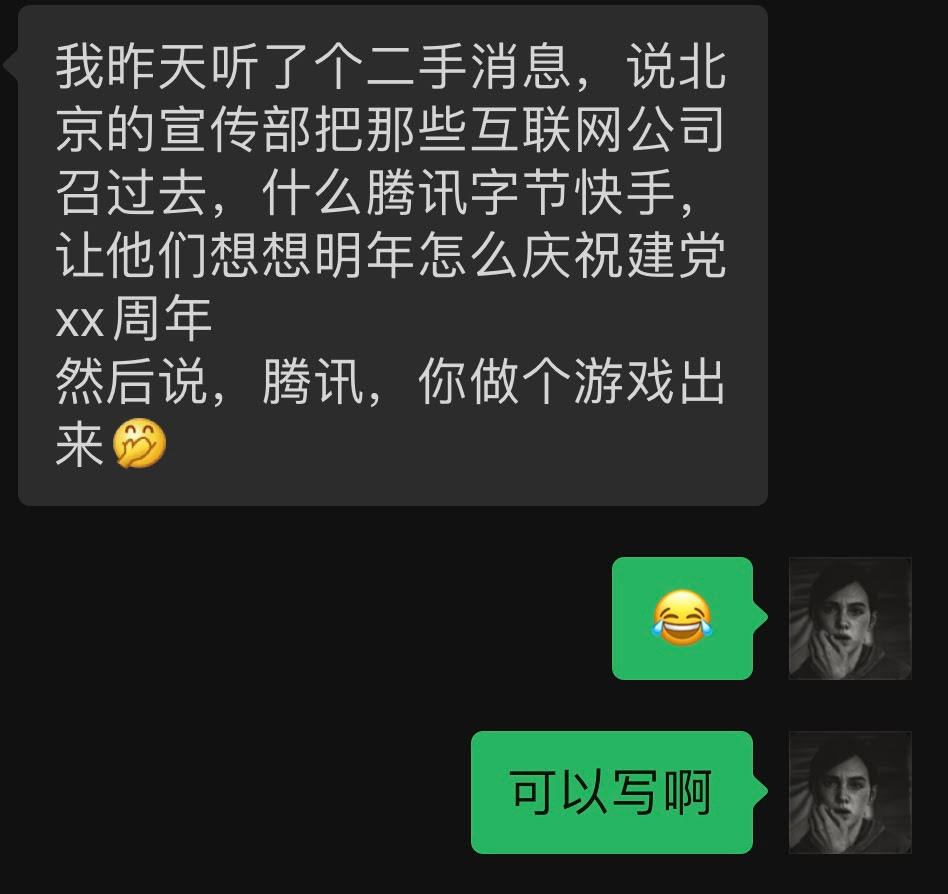

Words on the street are that the Publicity Department had already summoned multiple Chinese tech giants to brainstorm ideas for their forthcoming gifts to the party. When it came to Tencent’s turn, the department asked Tencent to make a game.

And this will not be unprecedented. In October 2019, Tencent released an idle clicker called Homeland Dream just in time for the 70th anniversary of the founding of the People’s Republic of China.

This is what was written in the story at the time:

Homeland Dream is playable propaganda. The game tasks players with picking a Chinese city -- including Hong Kong -- and watching it grow richer and more popular no matter what you do. If you want to make it richer faster? Just go ahead and enact China’s Belt and Road Initiative for an instant boost…

At first glance, Homeland Dream resembles games like SimCity. While it shares the same look and does involve placing buildings on a map, this is really an idle clicker, a type of game that’s automated to play itself.

(For the record, I didn’t use the phrase “disturbingly addictive” in my draft. It was part of an edit. Sounds a bit biased and emotional to me. But that’s for another story.)

#3 Going overseas, an unstoppable trend

As mentioned above, the main theme of the industry right now is to go overseas, or Chuhai in Chinese. Last year was a historic year.

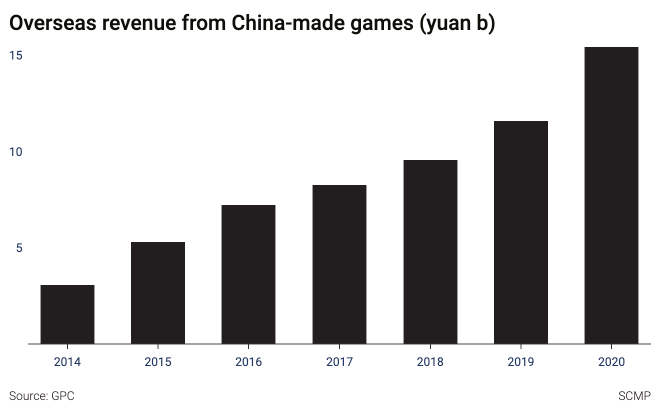

According to the 2020 Chinese Games Industry Report, the revenue Chinese games have hauled in from overseas markets has reached a whopping US$15.4 billion, up 33.25% from the year before. Put differently, that is the equivalent of 100 billion yuan.

There is no reason for this trend to deaccelerate anytime this year. If anything, they may crank it up a notch. One sign of it is how Alibaba is now taking its highly popular strategy game Romance of the Three Kingdoms: Strategy Edition to Hong Kong in the new year.

#4 IP games continue to impress

Another trend that will maintain momentum this year is the proliferation of IP games.

This weekend, I’ve published a big focus piece highlighting this trend.

With deep pockets and years of experience in adapting games for smartphones, these Chinese companies are driving that effort through partnerships with foreign studios in their quest to dominate the world’s video games market, which reached US$175 billion in revenues last year, according to industry research firm Newzoo.

Tencent is already widely known for its mobile versions of hit games like Pokémon, Call of Duty and Player Unknown’s Battlegrounds (PUBG). The next game to get the Tencent mobile treatment could be Assassin’s Creed, which is expected after a recruitment ad from the company earlier this month featured a Chinese warrior striking a classic pose from the game with arms crossed over the chest. Tencent bought a 5 per cent stake in Ubisoft, the French owner of Assassin’s Creed, in 2018.

While many gamers have traditionally perceived mobile gaming as an inferior experience to playing on consoles or PC, Tencent has been largely responsible for helping close that gap. Some of its mobile versions of popular games have gone on to surpass the success of the original titles.

PUBG Mobile, for instance, was the highest-grossing mobile game in 2020, generating US$2.6 billion in revenue, according to data from Sensor Tower. The rapid growth of Call of Duty: Mobile, which launched internationally at the end of 2019 and in China a year later, suggests it has potential to become even more popular.

ICYMI: Assassin’s Creed in China and on mobile is happening. CODM developer TiMi, which is also tasked with making Pokémon Unite, had put out a not-so-subtle recruitment ad.

#5 Genshin Impact lookalikes to emerge

Genshin Impact lookalike games are coming.

In fact, right around Genshin Impact’s record-breaking launch, we’ve already seen multiple Chinese game studios putting up trailers showcasing their answers to Genshin Impact. Chief among which are Tower of Fantasy and 狩猎时刻 (English translation: Hunting Time).

Tower of Fantasy, in particular, has come under the spotlight a bit. If the look is anything to bo by, it does look impressive. Unfortunately, reviews of the game’s earlier beta build have not been the most glowing, to put it mildly. However, it now has just undergone an overhaul, and buzz around the game is finding its way back.

Hunter Time, on the other hand, looks very much like an anime Monster Hunter knockoff. I mean the logo is a dead giveaway as to where the game’s inspiration came from. But hey, gamers first protested Genshin for copying the look of Breath of the Wild, and look where it has gotten it?

Whatever the case may be, one thing is for sure: Erciyuan or ACG games are here to stay.

#6 ByteDance to release mid-core games

ByteDance is an existential threat to Tencent. Experts see ByteDance’s long-term strategy as mimicking that of Tencent, namely pairing social media with video games. After all, gaming is one of the best ways to monetize internet traffic which ByteDance is so good at attracting.

As such, ByteDance’ founder Zhang Yiming has been reportedly gaming quite a bit to gain a deeper understanding of the business and the products. It surely has surprised me given his reputation, ever since college, as a no-game, all-business, hyperrational T-800 incarnate.

Jokes aside, ByteDance is serious about getting into games. It is on a hiring spree and deploying heaps of resources in the vertical. So when Genshin Impact was all the rage, Zhang payed his due in trying out miHoYo’s big hit. (But hilariously, he found out that his employees were spending work hours talking about the game in group chats, which infuriated him.) Anyway, Zhang has reportedly moved onto Sony’s Ghost of Tsushima in recent weeks, as revealed by ByteDance employees.

Indeed, although ByteDance has experienced impressive success with hypercasual games, it has yet to deliver a meaningful midcore title to resoundingly plant its flag in this space. Recently, Yang Dongmai, the head of one of ByteDance’ early centerpiece studios and an ex-Tencent vet, has left the company over a spiked project. I’ll expand on this storyline in the upcoming news round-up issue, so stay tuned.

That said, my money is still on ByteDance being able to release a capable midcore game this year.

#7 Tencent to explore paths to the Metaverse

Tencent is now studying ways through which it can leverage its games to build out the Metaverse, an interoperable network which, if seen through the lens of gaming, resembles an amalgamation of gaming, social network, and e-commerce.

More specifically, teams inside Tencent now have the mandate to turn games or build games into a virtual world (“虚拟世界级别的游戏” is how they put it). So here I’m not saying that Tencent will have a Metaverse product by the end of 2021, but rather that there will more signs of the Shenzhen-based tech giant working on this concept. After all, the Metaverse has become a recurring topic in many strategy meetings these days.

One area worth watching is what Tencent will do with its existing IPs. TiMi has already revealed that Honor of Kings will be getting spin-off games. It’s possible that these virtual-world-caliber games will be ultimately born out of existing IPs rather than brand new titles.

In previous issues, I’ve already written at length about how Tencent is positioned to take advantage of social gaming and, by extension, the Metaverse. Feel free to check those out.

#8 More brands to opt for in-game ad

Going hand in hand with the rise of social gaming, the business of in-game advertisement and product placements will continue to grow in China. Last year, Maserati, Tesla, Rolls-Royce, Häagen-Dazs, CLOT, and Burberry are all among brands that have deployed product placement in games.

And that’s not to mention the spate of game-themed merch put out by the likes of Nike, Adidas, and MAC. This year, video games will continue to stay as an attractive option for brands looking to connect with younger consumers.

Brands aside, local governments and government agencies are also looking for ways to promote themselves via games. An example is how the Zhangjiajie government is teaming up with Genshin.

#9 The fight against platforms to rage on

The first gaming story of the year was Tencent’s open spat with Huawei.

The recent public spat between Chinese internet giant Tencent Holdings and telecommunications equipment maker Huawei Technologies Co has highlighted a shift in the balance of power between game developers and distribution channels, as players increasingly focus their interest on a small number of popular games.

The dispute spilled into public view on January 1 when Huawei announced it had removed Tencent’s mobile games from its app store, the Huawei AppGallery. The move shocked netizens as Huawei accounts for 43 per cent of the domestic smartphone market and many of its users are also fans of Tencent games such as Honour of Kings.

[…]

According to sources familiar with the matter, the disagreement was over revenue sharing for Tencent games: Huawei wanted to retain a 50 per cent share of game revenues on its app store while Tencent argued for 30 per cent – in line with what Google Play and Apple’s App Store charge game developers.

Most Chinese Android app stores, which are preloaded on handsets from companies such as Huawei and Xiaomi, take a 50 per cent cut of the revenue generated by the mobile apps. The handset makers are able to take a bigger share of game revenues because Chinese developers often rely on pre-installed apps to reach players. As Google Play is blocked in China, home-grown app stores run by smartphone makers dominate the Android-based market.

This fight is by no means new. In the West, Epic’s showdown with Apple has been widely documented. But the pushback against platforms in China reached a new height when Genshin Impact and Rise of Kingdoms decided to boycott smartphone platforms, a move later commended by NetEase’ founder Ding Lei.

All things considered, the trend has become clear: Content is King.

It is worth noting that, with all these things happening, XD Network’s zero-commission game platform TapTap has recently been gaining ground. (Zheping from Bloomberg did a great piece on XD Network here detailing the story of XD Network and how its stock has risen.) This week IGG has announced that it is teaming up with TapTap, making it IGG’s primary distribution platform.

#10 The bundling of online video and games

OK, this one I stole from Dean Takahashi’s excellent list of 2021 predictions. This is what Dean wrote:

The big Hollywood companies — and their owners — are all pouring money into the streaming of movie and TV shows in a bid to ward off Netflix. But Netflix itself is moving into games, where engagement with an intellectual property can be far higher and more lucrative. We have seen Apple, Disney, NBCUniversal, HBO, and more move into movie streaming.

At the same time, we’ve seen Google, Microsoft, Sony, Amazon, Nvidia, Shadow, and Facebook all move into the streaming of cloud-based games. Microsoft has launched its Xbox Game Pass subscription in the hope of becoming the Netflix of gaming. It may not make tactical sense, but big companies will see the strategy that they can pursue to become even bigger and lock up more users. In the words of former MIT Media Lab director Nicholas Negroponte, “bits are bits.” You can stream games or stream movies and make money from both.

Surely, someone in this vast marketplace will see that the convergence of technologies and the economies of scale could favor a company that brings game streaming and movie streaming under one roof.

What immediately sprang to mind as I read this was what Tencent will do. Tencent has poured a ton of money into Tencent Video, making it one of the biggest movie and TV show platforms in China. With cloud gaming on the horizon, a subscription service bundling TV shows with games makes sense. That said, China is a whole different beast from the rest of the world in that as games need government approval, there are embarrassingly few blockbuster single-player games out there. So if a bundle does come about, it will likely be between recent indie games and online videos.

Thank you all for reading! While compiling this list, I was also prioritizing some of what I consider are the more unique or underreported perspectives. So I’m sure I’ve missed some important trends which deserve a mention with this list. So do write to me should you want to learn more about a certain topic of the industry.

Anyway, I can’t express enough how grateful I am for all the subscribers here. See you guys in the next one!